Renters Insurance in and around Macon

Macon renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Home is home even if you are leasing it. And whether it's a house or a townhome, protection for your personal belongings is a wise idea, even if you think you could afford to replace lost or damaged possessions.

Macon renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

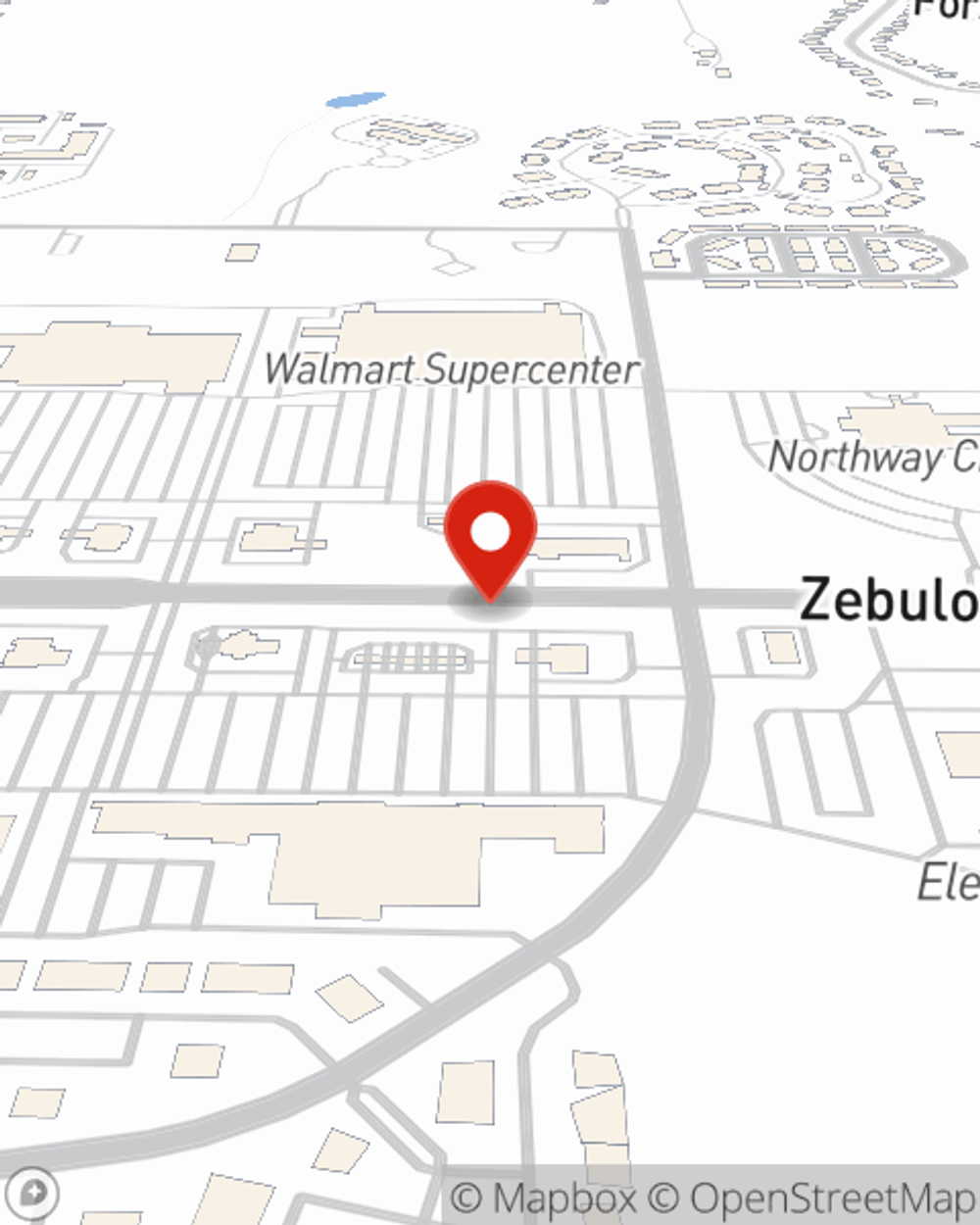

Agent Howard Hightower, At Your Service

Many renters don't realize how much money they have tied up in their possessions. Your valuables in your rented home include a wide variety of things like your tool set, video game system, couch, and more. That's why renters insurance can be such a good idea. But don't worry, State Farm agent Howard Hightower has the personal attention and experience needed to help you examine your needs and help you keep your things safe.

A good next step when renting a apartment in Macon, GA is to make sure that you're properly insured. That's why you should consider renters coverage options from State Farm! Call or go online now and see how State Farm agent Howard Hightower can help meet your renters insurance needs.

Have More Questions About Renters Insurance?

Call Howard at (478) 474-3135 or visit our FAQ page.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Howard Hightower

State Farm® Insurance AgentSimple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.